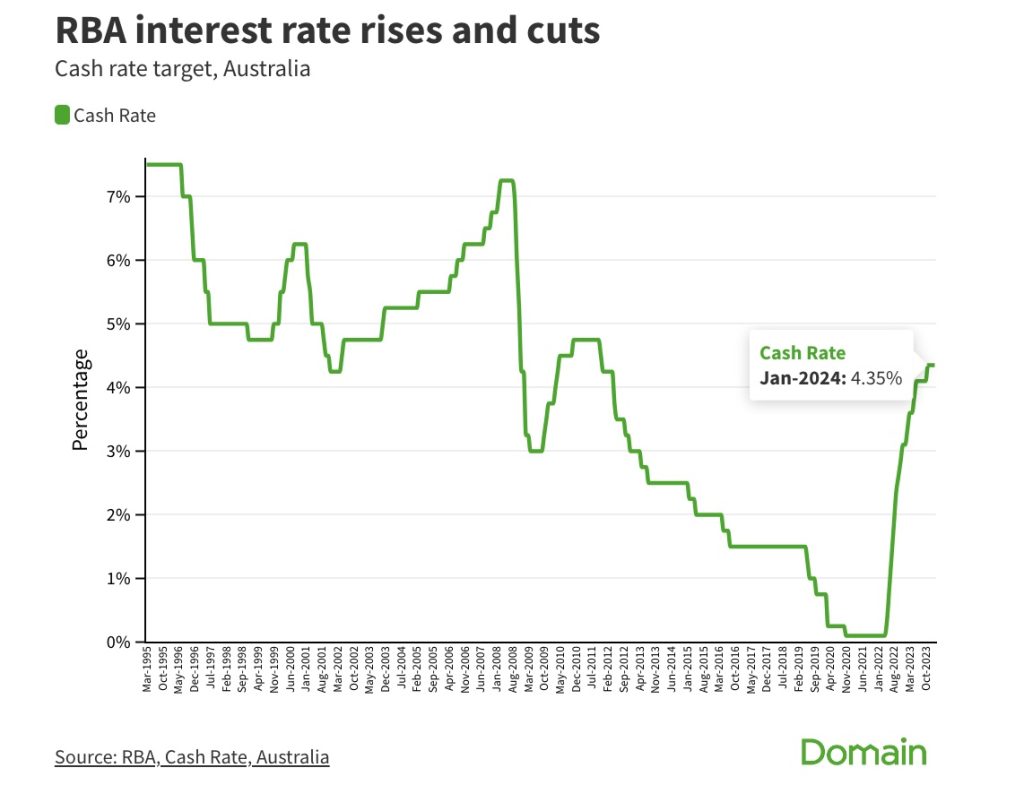

On February 6th, during the Reserve Bank of Australia’s (RBA) press conference, a significant economic decision was witnessed: following their first meeting of 2024, the RBA announced that the cash rate would remain at 4.35%. This decision was made after assessing the unexpectedly significant drop in inflation in the last quarter of the previous year, coupled with weak household spending during the holiday season. Experts commonly predict that it is unlikely for the RBA to lower the interest rate before August.

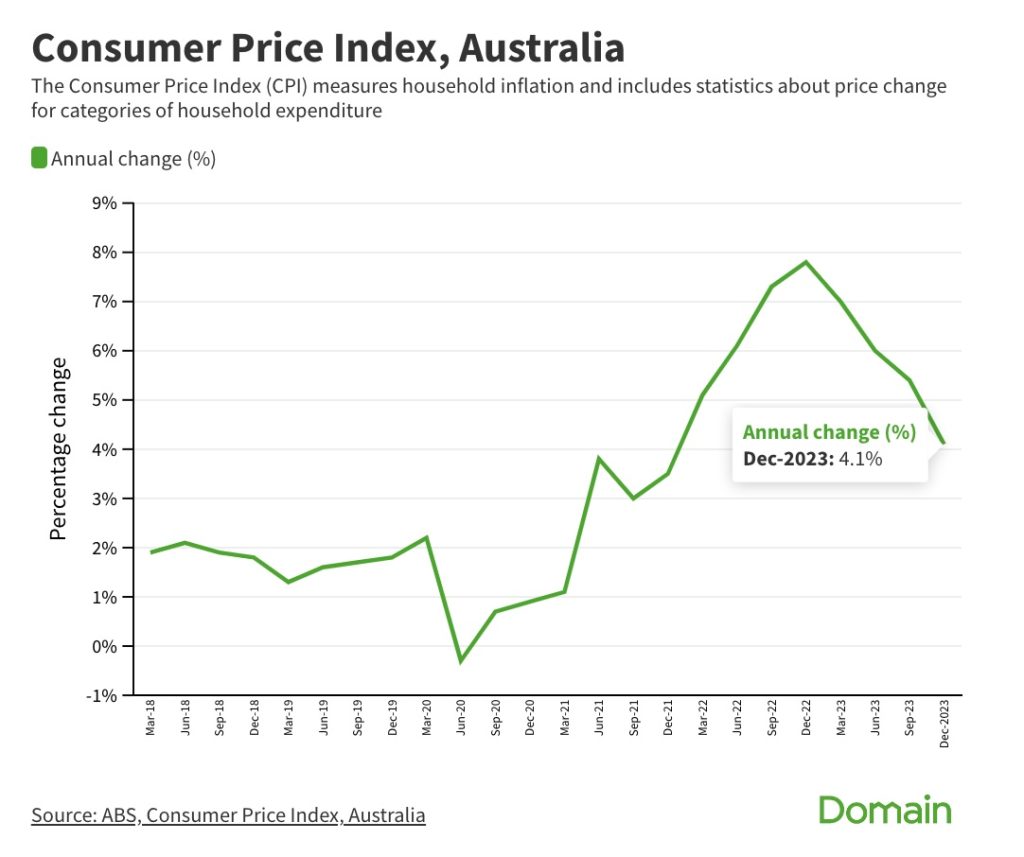

Notably, the Consumer Price Index for the fourth quarter of 2023 revealed that inflation had fallen to 4.1%, the lowest in two years and below the RBA’s earlier prediction of 4.5% in November. This is a significant decrease compared to the third quarter’s inflation rate of 5.4%. The Organisation for Economic Co-operation and Development (OECD) has issued a cautionary note, advising the RBA and other central banks not to hastily lower official interest rates. Despite the improved outlook on inflation, the OECD emphasized the need for continued tight monetary policy to ensure long-term price control.

“To ensure sustained control over potential inflationary pressures, monetary policy needs to remain cautious,” stated the OECD. “While the decline in inflation does create room for reducing policy rates, the policy stance for most major economies should remain restrictive for some time.”

For many Australians, the current cash rate of 4.35% might represent a peak, with expectations of a gradual decrease to follow. Taking into account the current economic conditions and market indicators, it can be inferred that the market is at a potential turning point, offering favorable opportunities for those considering entering the market.

The stability of interest rates is a positive signal for the real estate market, reflecting overall economic stability and providing a more predictable environment for homebuyers. Additionally, this stable or downward trend in rates typically increases the appeal of the real estate market, as lower loan costs make purchasing property more affordable.

However, potential homebuyers must understand and assess the underlying risks. Although the current rate is stable, the market is not without risks. The decline in inflation is positive but remains above the RBA’s target range, suggesting future economic uncertainties. Furthermore, government measures such as temporary tax cuts and cost of living subsidies may have short-term market impacts, with their long-term effects yet to be observed.

Despite these uncertainties, there are positive signs for the future trends of the real estate market. The potential growth in housing prices could offer profitable opportunities for investors, and as the economy gradually recovers, increased demand might further stimulate the market.

In summary, under the current economic conditions, now appears to be an appropriate time for those considering entering the real estate market. The stability of interest rates and the gradual decline in inflation provide a relatively favorable purchasing environment for homebuyers. However, buyers should thoroughly understand market dynamics and carefully assess all relevant factors before making a decision. In the real estate market, information and timing are key to successful investment.

Experience Effortless Living with a Single Contract at Rouse Hill Villas in Sydney’s Northwest. Avoid the Common Pitfalls of House and Land Purchases.