Week’s Key Focus

Australia is grappling with its highest unemployment rate in two years, reaching 4.1%, which has sparked widespread anticipation of impending rate cuts by the Reserve Bank of Australia (RBA). As reported by The Australian Financial Review and the Australian Bureau of Statistics (ABS), there was a sharp increase in the number of unemployed individuals in January, with 22,000 more Australians out of work. This surge pushed the unemployment rate from its previous 3.9% to 4.1%. Additionally, there was a notable 2.5% decrease in the number of hours worked, despite the overall employment figures remaining at an all-time high of 14.2 million. This downturn in the job market has been attributed to the holiday season’s lull. Despite this, under the Labor government’s tenure last year, Australia hit a record with the creation of 650,000 jobs. Treasurer Jim Chalmers has highlighted that the current slowdown in the labour market is a reaction to the ongoing hikes in interest rates, soaring inflation, and the murky waters of global economic uncertainty.

Bjorn Jarvis from the ABS remarked that this is the first time since January 2022 that the unemployment rate has crossed the 4% threshold, indicating that the labour force has expanded compared to the pre-pandemic era. The financial markets are now betting on a 0.25% rate cut by the RBA come September, with a 60% likelihood of another reduction in December. The RBA itself has projected that the unemployment rate could climb further to between 4.2% and 4.3% over the course of the year.

Economists have pointed out that the labour market’s performance in January was significantly below par, with holiday seasonality potentially playing a part. Senior economists Paula Gadsby from EY and Diana Mousina from AMP Capital have both noted that, despite the influence of seasonal factors, there is a clear weakening in the labour market. Job growth is expected to decelerate further. The labour market data in the upcoming months will be pivotal in assessing the Australian economy’s health and the RBA’s policy trajectory, shedding light on the potential for further economic interventions.

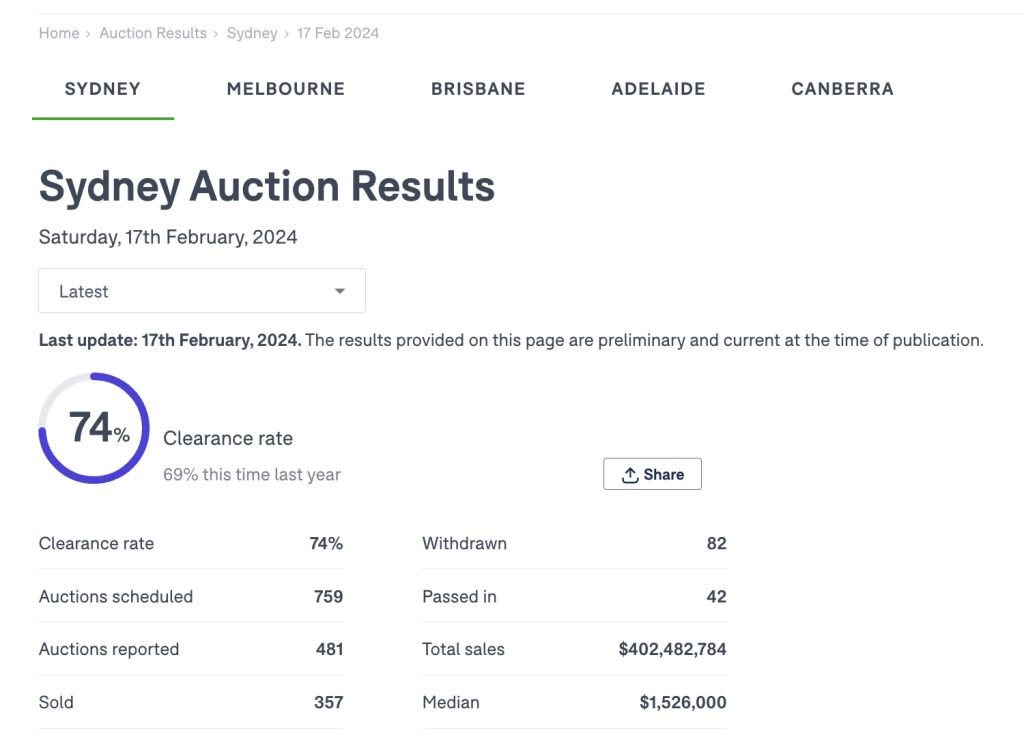

Auction Results Last Week

- Sydney: 759 properties were auctioned, with 481 auction results reported, 357 of which were sold, achieving a clearance rate of 74%. The total auction value was AUD 402,482,784, with a median house price of AUD 1,526,000;

- Melbourne: 868 properties were auctioned, with 660 auction results reported, 454 of which were sold, achieving a clearance rate of 69%. The total auction value was AUD 361,492,276, with a median house price of AUD 975,000;

Top 5 Auction Prices in Sydney Last Week: Houses

▼TOP 1. AUD $8,525,000

Address: 50 Fletcher St, Bondi NSW 2026

Land Size:442 sqm

House | 4 Bed | 2 Bath | – Parking

▼TOP 2. AUD $7,050,000

Address: 34 Greycliffe St, Queenscliff NSW 2096

House Size: 105 sqm

House | 5 Bed | 3 Bath | 2 Parking

▼TOP 3. AUD $5,150,000

Address: 7 Illawong Av, Tamarama NSW 2026

Land Size: 295sqm

House | 4 Bed | 3 Bath | 2 Parking

▼TOP 4. AUD $4,900,100

Address:76 Wymston Pde, Abbotsford NSW 2046

Land Size: 468 sqm

House | 3 Bed | 2 Bath | 4 Parking

▼TOP 5. AUD $4,420,000

Address:21A Wyalong St, Burwood NSW 2134

Land Size: 457 sqm

House | 6 Bed | 6 Bath | 3 Parking

Top 5 Auction Prices in Sydney Last Week: Units

▼TOP 1. AUD $5,350,000

Address: 3801/184 Forbes St, Darlinghurst NSW 2010

Unit | 3 Bed | 2 Bath | 2 parking

▼TOP 2. AUD $5,000,000

Address: 3 Olive St, Paddington NSW 2021

Teraace | 4 Bed | 3 Bath | 1 Parking

▼TOP 3. AUD $3,210,000

Address: 2 Printers La, Darlinghurst NSW 2010

Terrace | 3 Bed | 2 Bath | 1 Parking

▼TOP 4. AUD $3,200,000

Address: 32 Gipps St, Paddington NSW 2021

Terrace| 3 Bed | 2 Bath | – Parking

▼TOP 5. AUD $2,700,000

Address: 6 Norfolk St, Paddington NSW 2021

Terrace | 2 Bed | 1 Bath | – Parking