Week’s Key Focus

In Australia, soaring house prices mean that homebuyers with average incomes—whether individuals, couples, or families—are finding that the value of property they can afford with the same amount of money is steadily shrinking.

According to RealEstate.com.au, PropTrack data shows that despite a significant reduction in borrowing capacity due to rising interest rates compared to two years ago, national house prices still hit a new high in April. Since May 2022, the purchasing power of couples and families on an average wage has dropped by $250,000, while for individuals, it’s decreased by about $200,000.

Interest rates have increased thirteenfold over the past few years, significantly affecting borrowing capacity. Compared to two years ago, homebuyers’ borrowing power has dropped by about 35% to 40%. The latest PropTrack Home Price Index shows that the median house price in Australia reached a historic high in April, up 6.6% year-on-year.

The report indicates that couples without children have the strongest purchasing power, followed by families and individual buyers. According to the Australian Bureau of Statistics, in November last year, the average annual salary for full-time workers in Australia was $98,217. Under certain assumptions, a couple without children earning $196,435 annually and a family with a combined income of $150,000 could potentially buy a property worth up to $950,000 with a mortgage.

When the loan amount exceeds 80% of the property’s value, buyers need to pay Lender’s Mortgage Insurance (LMI) and other upfront fees, which are included in the deposit. Families with the same income and deposit may only be able to afford a property worth about $850,000. Living costs, particularly childcare and school fees, are the main reasons for the difference in purchasing power between couples without children and those with families. Meanwhile, an individual buyer on an average annual salary could afford a property worth $510,000 with a $100,000 deposit.

In expensive markets like Sydney, single homebuyers may need to look further from the CBD to find properties within their budget.

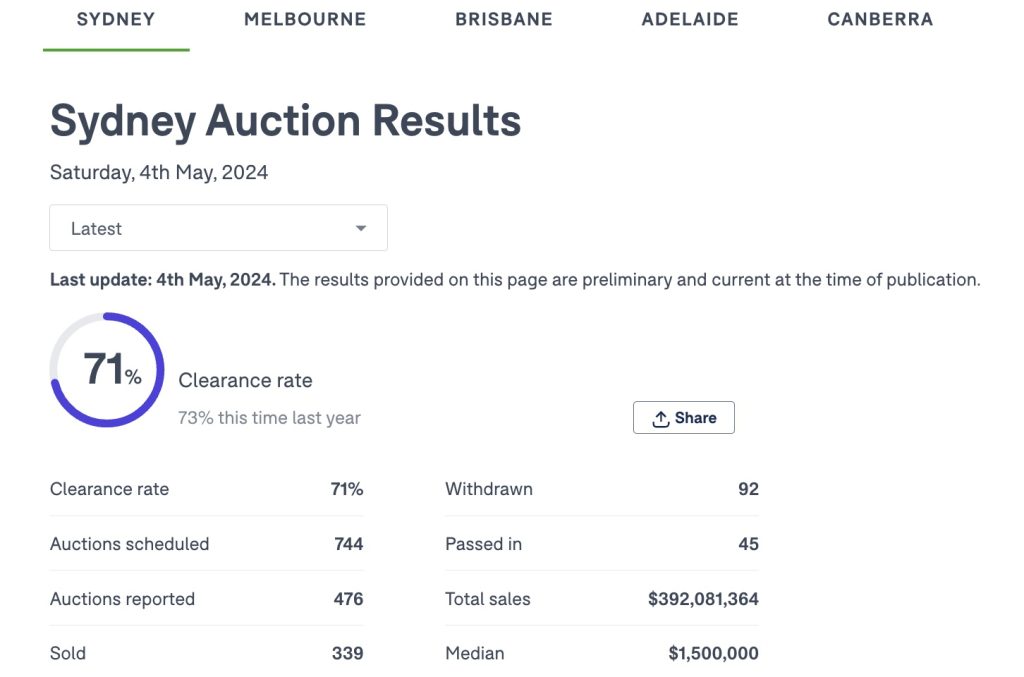

Auction Results Last Week

- Sydney: 744 homes went to auction, 476 results reported, 339 sold, with a clearance rate of 71%. The total auction value was AUD 392,081,364, and the median house price was AUD 1,500,000.

- Melbourne: 985 homes went to auction, 697 results reported, 428 sold, with a clearance rate of 61%. The total auction value was AUD 324,514,600, and the median house price was AUD 912,000.

Top 5 Auction Prices in Sydney Last Week: Houses

▼TOP 1. AUD $4,850,000

Address: 5 Ortona Rd, Lindfield NSW 2070

Land Size: 1138 sqm

House | 6 Bed | 4 Bath | 2 Parking

▼TOP 2. AUD $4,500,000

Address: 98 First Av, Five Dock NSW 2046

Land Size: 626 sqm

House | 4 Bed | 3 Bath | 3 Parking

▼TOP 3. AUD $4,325,000

Address: 23 The Greenway, Duffys Forest NSW 2084

Land Size: 2075 sqm

House | 5 Bed | 3 Bath | 3 Parking

▼TOP 4. AUD $4,010,000

Address:25 Gallipoli St, Lidcombe NSW 2141

Land Size: 613 sqm

House | 8 Bed | 5 Bath | 6 Parking

▼TOP 5. AUD $3,750,000

Address:12 Stewart St, Balmain NSW 2041

Land Size: 280 sqm

House | 4 Bed | 2 Bath | – Parking

Top 5 Auction Prices in Sydney Last Week: Units

▼TOP 1. AUD $7,000,000

Address: 38/20 Bonner Av, Manly NSW 2095

Unit | 3 Bed | 2 Bath |2 parking

▼TOP 2. AUD $7,000,000

Address: 11/122 Bower St, Manly NSW 2095

Unit | 3 Bed | 2 Bath | 1 Parking

▼TOP 3. AUD $3,600,000

Address: 504/35 Bowman St, Pyrmont NSW 2009

Unit | 3 Bed | 2 Bath | 2 Parking

▼TOP 4. AUD $2,320,000

Address:1/3 Ormond St, Ashfield NSW 2131

Townhouse | 4 Bed | 3 Bath | 4 Parking

▼TOP 5. AUD $2,300,000

Address: 7/321 Edgecliff Rd, Woollahra NSW 2025

Unit | 3 Bed | 2 Bath | 1 Parking